How Kizyr Works

Once you have become Kizyr member, you can create your own Savings Group (Kitty) and invite your contacts to start saving along with you.

We have organized Kizyr's food drive for COVID-19 relief. The campaign aims to help students in these difficult times. You can get meal vouchers to buy food from our partner restaurants, vouchers available on first come, first served basis.

Learn More

In many cultures kitties have been a long-standing method of saving money in a group. People of similar interest save towards their goals, promoting personal savings with help of their own social circle.

This is a proven savings method that has been effective in South-East Asian, South American and Middle Eastern countries for centuries!

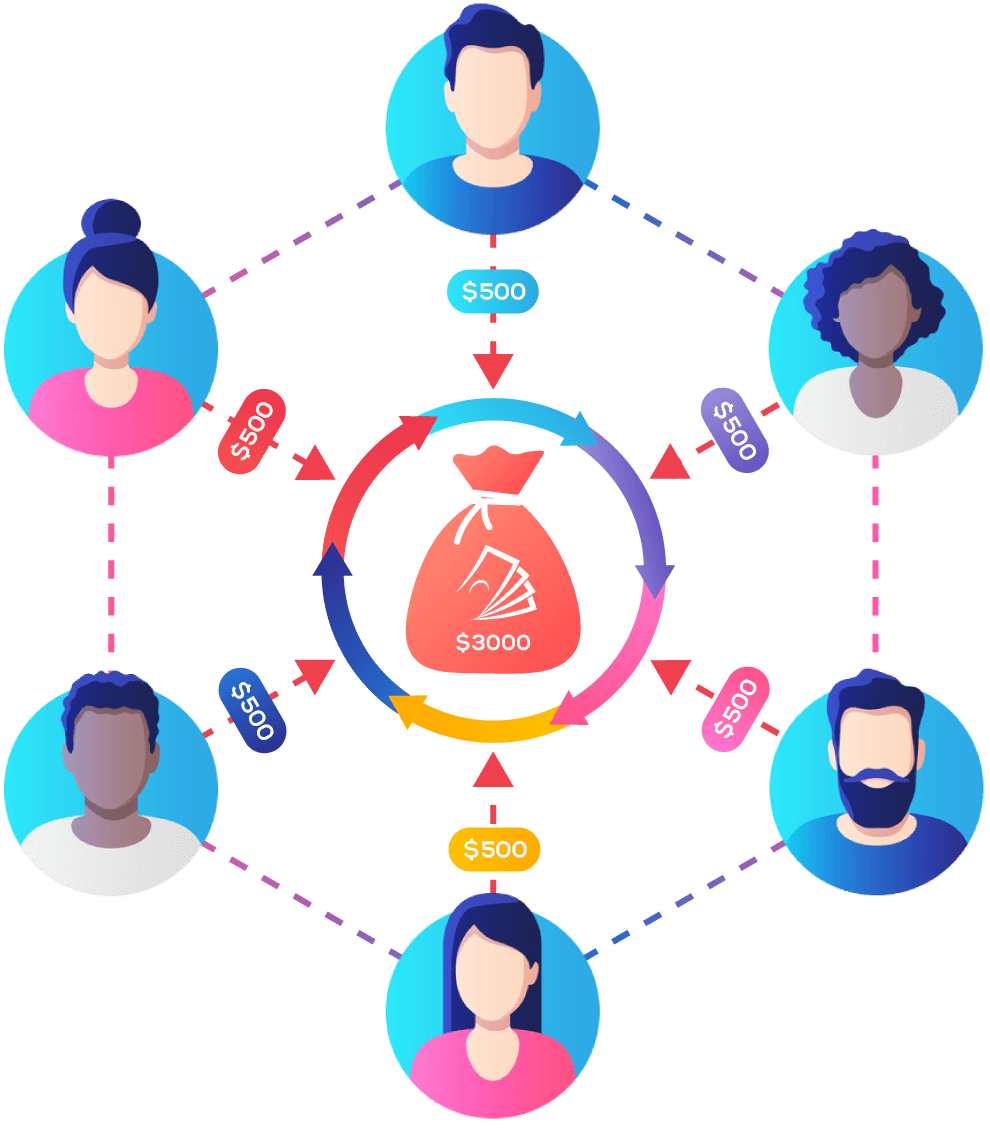

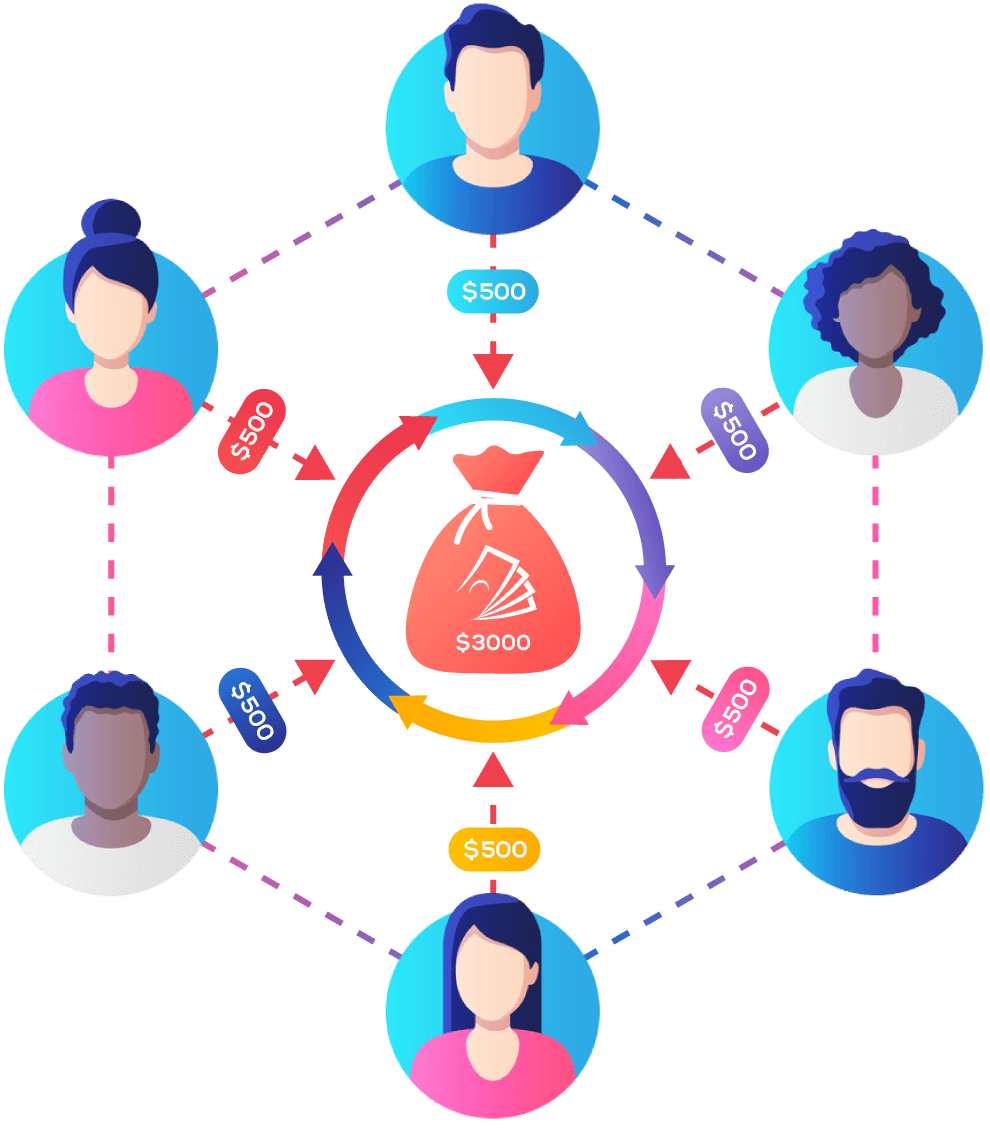

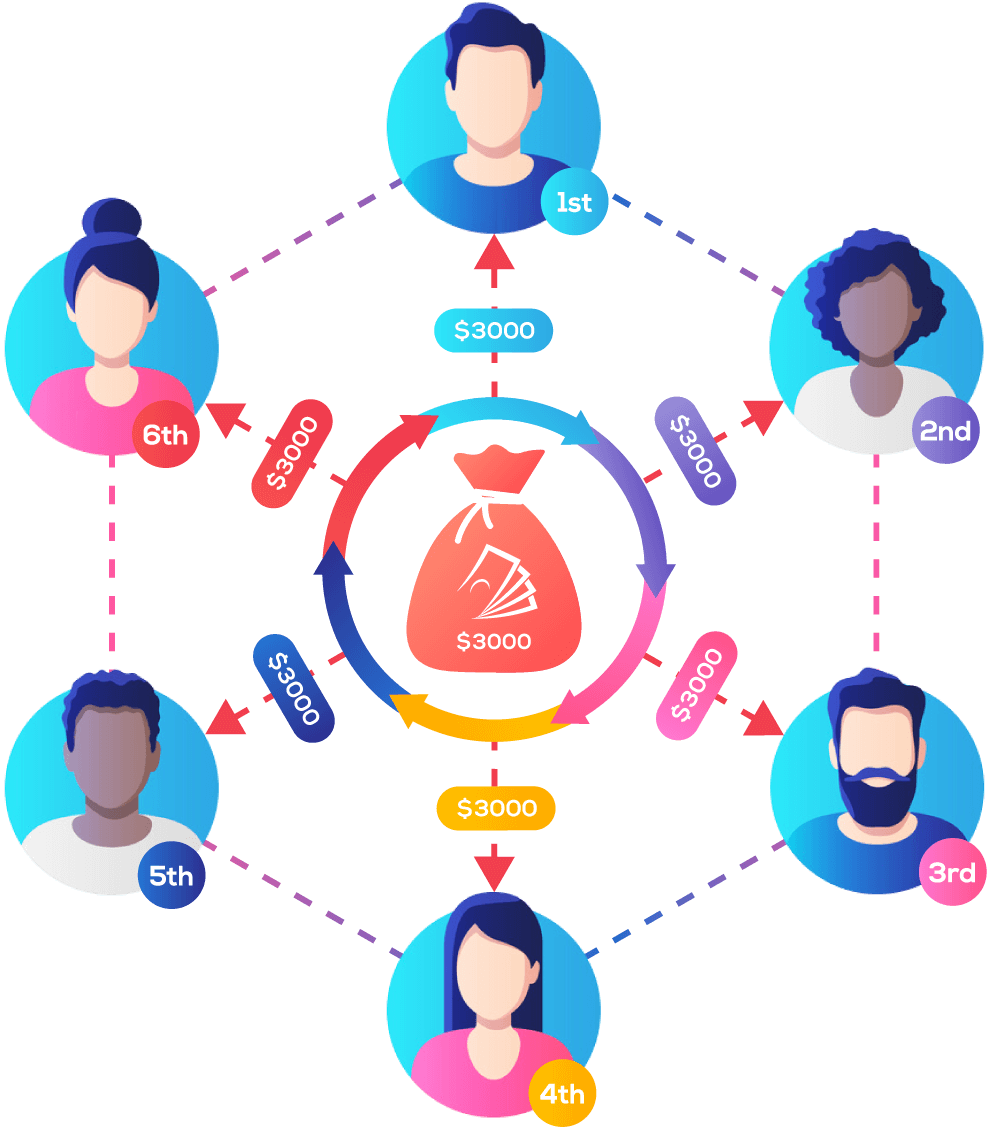

Kizyr members join a savings circle of 5 - 12 people. Each group member contributes a set amount of money into the shared kitty with one member then taking the full amount.

Every group member makes regular contributions into the shared kitty. This repeats over time until everyone in the group receives a payout a.k.a. award.

Members take their payout or award one by one. The more you successfully use Kizyr, the more you’ll practice good savings habits and build your rewards score, unlocking access to discounts on purchases made through your savings.

We are lauching soon. Stay connected by subscribing to our newsletter.

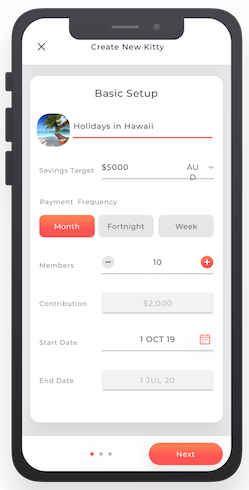

Once you have become Kizyr member, you can create your own Savings Group (Kitty) and invite your contacts to start saving along with you.

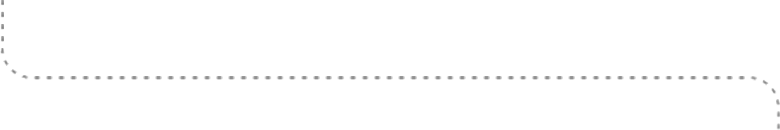

STEP 1

Set the savings target.

Choose when is your group starting savings.

You can create a weekly, fortnightly or monthly kitty.

STEP 2

Send invites with your kitty proposal.

Add members from your phone book contacts.

Invites are sent to all members with the details of your kitty.

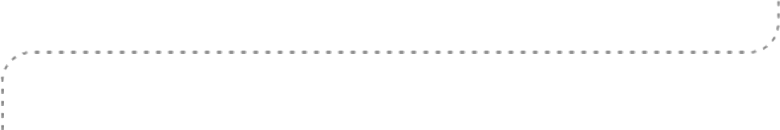

STEP 3

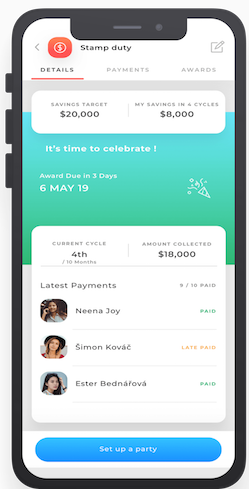

Your personalised kitty is ready.

Start saving the contributions in the kitty as per schedule.

Get automatic reminders for upcoming installments.

Record your own payments and see the status of other members.

STEP 4

Achieve your savings target. Collect lump sum payout.

Hooray! You did it. Share the excitement with the group.

Enjoy the accomplishment.

Repeat

Saving money is not easy, but it can be made convenient by saving in a group. Group savings give you the accountability and peer pressure to keep going and finally reach your target..

In a group of 5 - 12 people, everyone is working together and everyone is winning. This enables financial stability and prosperity for the community

Used by over 1 billion people from India, Malaysia, China, Keny, Mexico, Latin America. Known by many different names, such as susu in Ghana, gamias in Egypt, chit funds in India, cundina in Mexico, kye in Korea, huey in Thailand, hui in China and committee in Pakistan.

Maria is a full-time student studying at university, she lives in a shared house. She has a part-time job some evenings and on the weekends. Maria is reluctant to accumulate debt via a traditional loan or a HECS debt to cover her university fees and tuition costs. She has a close social circle that are willing to band together and lend her the money through a Kitty.

Learn MoreMichael is a 23-year-old who works full time, lives at home with his parents. He has a car loan as well as some credit card debt totalling $5,000. He would like to pay out his debts as quick as he can to maximise the amount that he is eligible to borrow for a home loan as mortgage lenders do not look favourably upon personal loans and credit card debt. He knows that if he can wipe out this debt quickly, not only will he improve his credit rating, but he will be able to look for a home sooner specially at a higher price range.

Learn More

Nicole and her group of 4 friends are in their mid-20’s and love to shop but have poor budget and spending habits. They often over-spend and end up with high credit card debts that have large interest rates meaning it is often a long time until they can afford to pay them off. They find that they have trouble budgeting their finances on their own and as a result they have been cut-off from any finicial support from their parent until they can get their finances in order.

Learn More